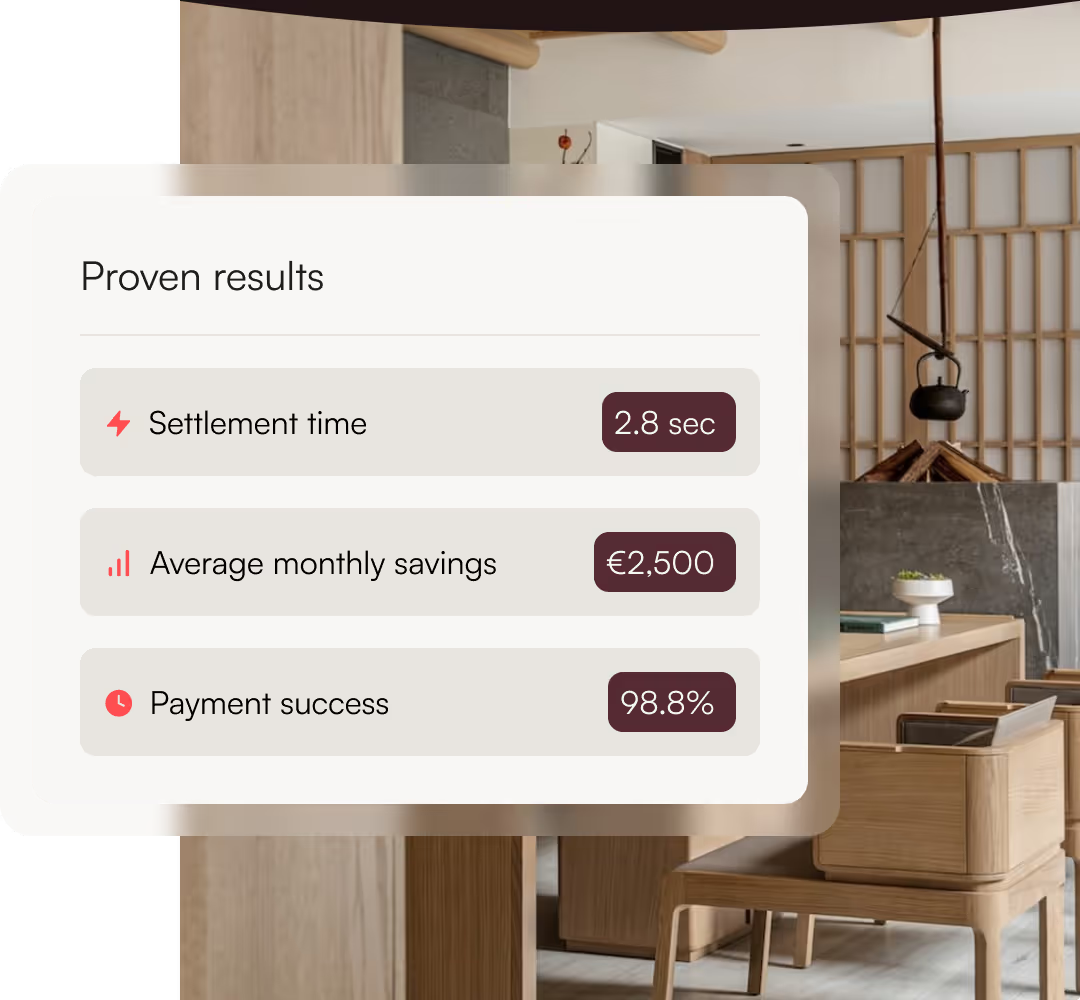

Get paid instantly, lower costs, automate reconciliation

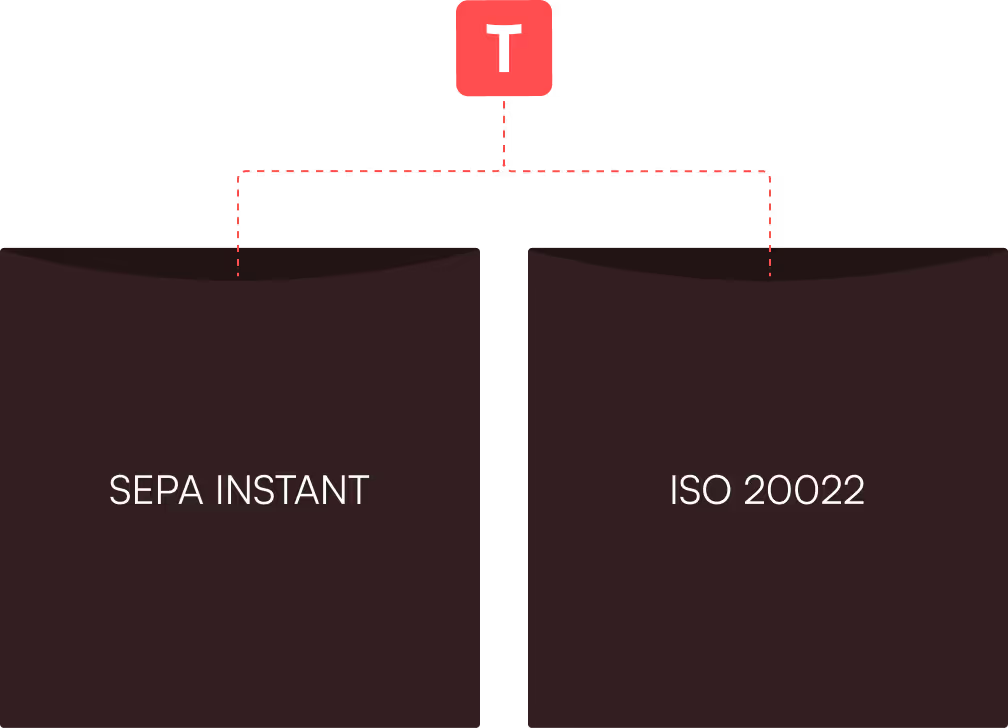

Request to Pay infrastructure for European businesses. Built on SEPA Instant and ISO 20022 standards that banks and payment networks trust.

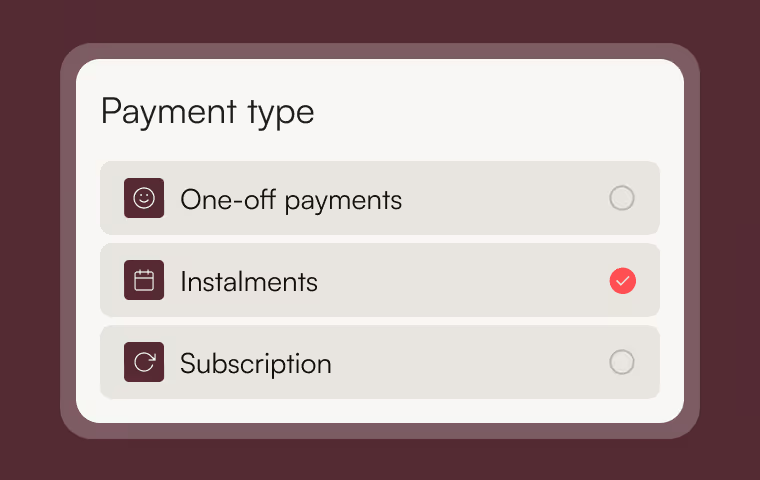

Handle any payment your business needs

One-off payments, subscriptions, instalments. One infrastructure that handles them all.

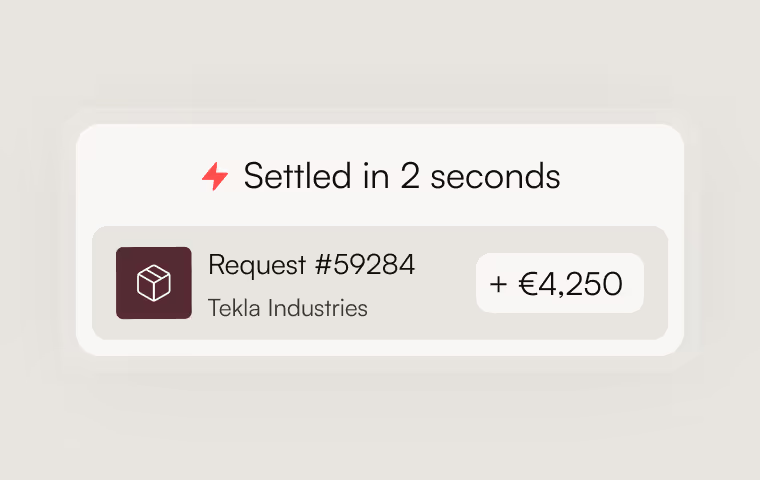

Get paid instantly

Settlement in seconds, not days. Money lands in your account immediately - better cash flow, no waiting for traditional bank transfers.

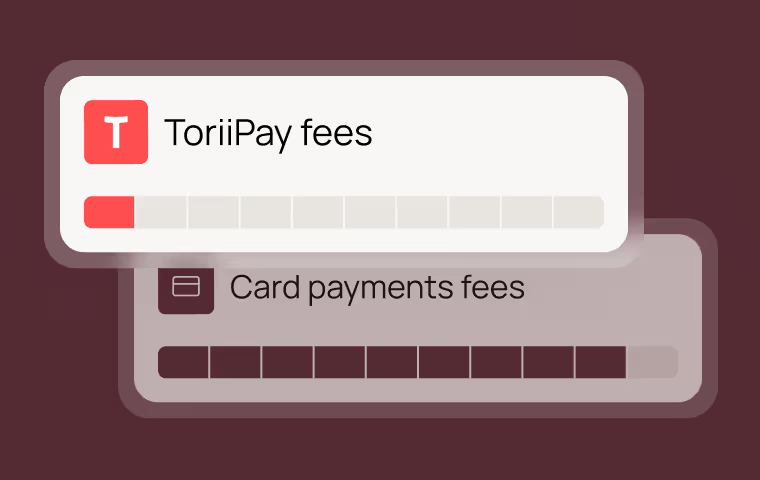

Lower processing costs

Up to 10× cheaper than cards. Reduce payment fees significantly compared to 2-3% card rates. Lower costs mean more profit stays in your business.

Better customer experience

Approvals happen inside trusted banking apps. Customers approve payment requests through their bank without entering card details or additional redirects.

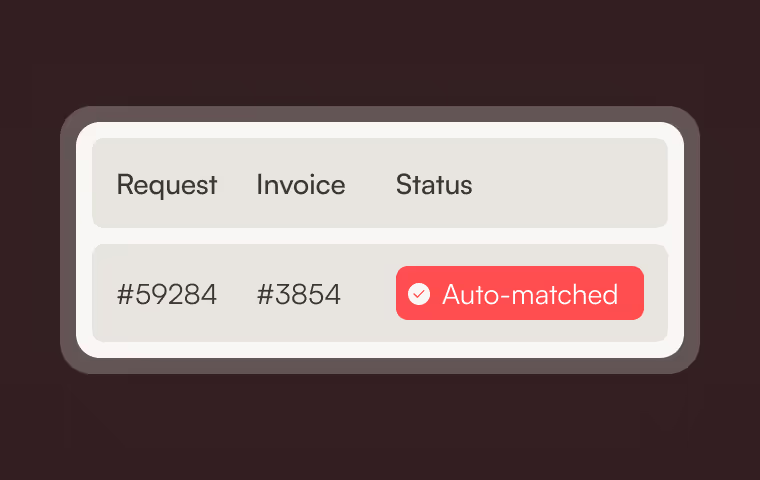

Automated reconciliation

Every request carries structured data for clean settlement. Payments automatically match with invoices using structured data. Eliminate hours of manual reconciliation work every week.

B2B invoices made simple

Reduce late payments and disputes with trackable, structured payment requests. Supplier sends a digital request tied to an invoice; buyer approves instantly, no weeks-long delays.

Cross-border ready

One system across Europe, designed to scale globally. Same infrastructure works whether your customer is in Germany, France, Spain, or Poland.

Flexible options for service providers

Offer instalments or recurring bills all confirmed in the customer's bank app. Subscriptions managed through automated RTP requests, with customers approving recurring charges in advance.

Payment solutions for every industry

From e-commerce to utilities, instant payments solve real business challenges across sectors

E-commerce

Instant refunds and one-click checkout. Reduce cart abandonment and boost satisfaction.

Perfect for high-volume retailers. Enable instant refunds and seamless checkout that converts better.

SaaS

Automated recurring billing with instant settlement. Predictable revenue, reliable collection.

Ideal for subscriptions. Achieve 95%+ on-time collection with zero manual follow-up.

Manufacturing

Pay suppliers instantly. Improve terms and reduce payment cycles from weeks to seconds.

Built for B2B operations. Better supplier terms and improved working capital management.

Logistics

Real-time freight settlements. Eliminate cash flow gaps and automate invoice reconciliation.

Designed for transport. Instant settlements eliminate delays between delivery and payment.

Utilities

Digital payment requests and automated recurring bills. Reduce costs, improve payment rates.

Perfect for recurring billing. Eliminate paper costs and improve on-time payment rates.

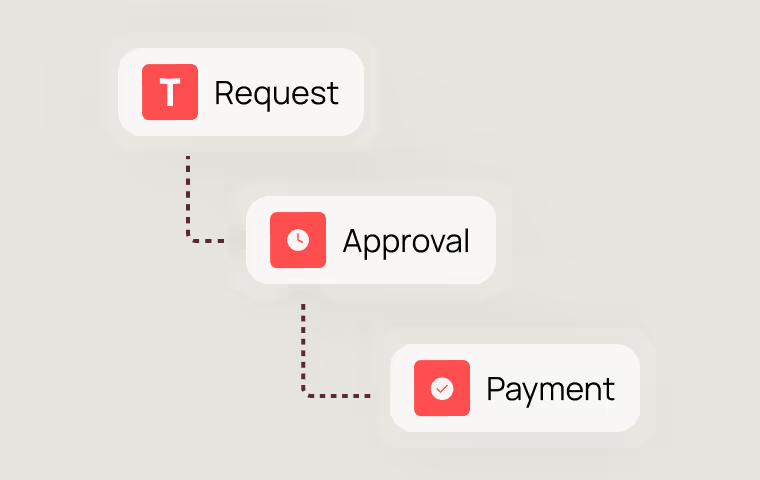

Start accepting instant payments in 3 simple steps

From integration to first payment in 2-3 weeks. Simple setup, dedicated support throughout.

Setup & integration

Connect ToriiPay to your system using our API or pre-built plugins. Access sandbox environment and documentation. Our technical team guides you through the process.

Testing & configuration

Test payment flows in sandbox with sample transactions. Configure branding, reconciliation rules, and reporting. Verify everything works perfectly before launch.

Go live

Launch to production and start accepting instant payments from customers. Monitor real-time dashboard, get dedicated support, and optimize as you scale.

Businesses transforming payments with ToriiPay

Manufacturing company eliminates production delays

Automotive OEM implemented instant supplier payments. Settlement in seconds triggers automated production, meeting tight JIT schedules.

From payment request to confirmed funds and production release

Automated production kickoff upon payment - no reconciliation delays

Freelance platform eliminates 7-30 day payment waits

Platform implemented instant payouts. Freelancers paid within seconds of completion, improving satisfaction and competitive positioning.

From 7-30 day waits to instant payment upon task completion

Fast payouts become competitive platform differentiator

Built on trusted European standards

Built on ISO 20022 and SEPA Instant - Europe's trusted payment standards. Your payments work seamlessly across 30+ countries with built-in compliance and security.

Frequently asked questions

Everything you need to know about getting started

What makes ToriiPay different?

We're built on SEPA Instant and ISO 20022 - trusted European standards, not proprietary tech. This means better security, regulatory compliance, and compatibility with banks across Europe. Plus, we focus on solving real business problems: instant settlement, lower costs, and zero manual reconciliation.

How complex is the integration?

Most businesses integrate in 2-3 weeks. We provide REST APIs, SDKs, and pre-built plugins for major e-commerce platforms. Our technical team supports you throughout implementation.

Can we trust the technology?

Absolutely. ToriiPay is ISO 20022-native and SEPA-aligned, meeting European banking security standards. Every transaction uses bank-grade encryption. We're recognized as an EBAday 2025 Finalist and built our infrastructure to meet the highest compliance requirements.

What about international payments?

ToriiPay works across all SEPA countries (30+ nations). One integration, pan-European reach. Cross-border payments settle as fast as domestic ones.

How will this impact our bottom line?

Most businesses see 50-70% reduction in transaction costs vs cards, instant cash flow improvement, and 80%+ time saved on reconciliation. Exact savings depend on your transaction volume and current payment mix.

Ready to get paid instantly?

See how ToriiPay can reduce costs, speed up settlements, and eliminate manual work for your business.